感觉是要的

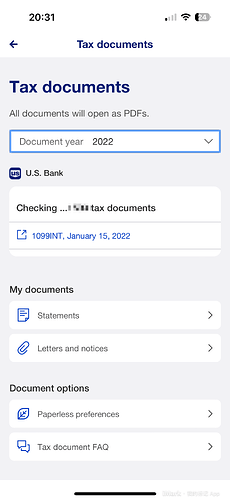

那我没收到咋办 ![]() 还是要找银行要吗

还是要找银行要吗

谢谢,chase是没有的,Santander已经关了 ![]() 我还是打电话吧

我还是打电话吧

NRA刚收到1042-S可以无视吗 ![]()

赶紧amend不然明天IRS就来查水表了

认真回答,IDK ![]()

Sprintax嘛 ![]()

如果是Fidelity的开户奖励呢?它可不是银行,得扣30%的税吧。而且你这样自己填1040NR就只好paper file了吧?

lz说的是NRA开户奖励收到1099-INT的情况。而实际上即使银行弄对了你收到了1042-S,IRS关于怎么报也没有说的很清楚,甚至自相矛盾。

上面也有人提到了

对于正确发了的1042-S应该也是一样。然而question L on page 5 of Form 1040-NR是用来填Treaty的。

如果强行按照IRS要求来填,那按我理解只能在1040-NR Schedule OI question L那里填上US-China Tax Treaty Article 10

ARTICLE 10 (Interest)

Interest arising in a Contracting State and paid to a resident of the other Contracting State may be taxed in that other Contracting State.

However, such interest may also be taxed in the contracting State in which it arises and according to the laws of that Contracting State, but if the recipient is the beneficial owner of the interest, the tax so charged shall not exceed 10 percent of the gross amount of the interest.

. . . . . .

另一种报法就是按照一楼说的做,除了对于1042-S不需要

这种方法应该也是大部分报税软件(e.g. Sprintax, OLT)对于NRA报1042-S选择income not effectively connected to the US的处理。

P.S.不管哪种方法应该都没办法e-file ![]()

研究了一晚上OLT,如果用第一个方法,会提示e-file不支持US-China Tax Treaty Article 10;第二个方法会提示Schedule NEC里填了小于10%的税率 & Interest Tax Rate小于30%

所以不填不就完了,就可以efile了

1099-INT不填问题不大,1042-S是要求report的

Chapters 3 and 4 usually require reporting of such interest.

我用OLT也是只能弄成这样然后打印准备paper file

重点是研究了一晚上发现还是得跑邮局 ![]()

我今天刚拿OLT e-file了,为了e-file 1099-INT和1042-S的利息都没填进去,然后OLT可以给1040-NR添加attachment,我就把利息金额写了进去,现在已经accepted了(不知道这个的意思是IRS收到了我的return还是接受了我的return)

机智,我已经finalize改不了了只能去邮局了 ![]()

NRA利息类的1042s直接不管就行了

我前几天在找我这里的VITA帮我review,VITA她硬要帮我把所有的利息加起来填在30%那里,不附加额外的1042s ![]()

我把这个网页找出来说,irs不是说NRA不用报这个利息么?

她说你这个200多呢,这么多

我是这个是开户奖励,其实没有多少钱

然后就把所有的利息都删了,不提

个人情况:正确的w8ben开户,chase的225开户奖励发了1042s,income code29,chapter3,无withhold

交税和报税是两码事,不管显然不合适

你不欠税,也没有规定说不报罚款

report是指给你withhold了你可以报了拿回来

嘿嘿 都是按自己觉得合规心安的方式报 就感觉这就是报税里比较小的点 大家只是提供些经验过的、目前看没不良后果的、不构成建议的alternatives

IRS说这些东西在1042s上not subject to reporting

https://www.irs.gov/individuals/international-taxpayers/amounts-that-are-not-subject-to-reporting-on-form-1042-s

Amounts NOT subject to reporting under chapter 3:

- Payments made by individuals if the individuals are not making the payment as part of their trade or business and no withholding is required to be made.

- Bank deposit interest that is not effectively connected with the conduct of a U.S. trade or business.

- Original issue discount on certain short- term obligations.

- Nonbusiness gambling income of a nonresident alien playing blackjack, baccarat, craps, roulette, or big-6 wheel in the United States.

- Amounts paid as part of the purchase price of an obligation sold between interest payment dates.

- Original issue discount paid on the sale of an obligation other than a redemption.

- Insurance premiums paid on a contract issued by a foreign insurer.

以及利息对于用1040NR报税的NRA不应该在1040NR表格treaty问题之外的任何地方

是IRS说的,1042s和1040nr都不要报,而不只是不交

我认为报税要看IRS的规定,完全根据IRS原文进行报税操作。我对于IRS规定的subject to reporting的FDAP哪怕只有5美元的分红收入都上报并且补缴30%了。

大家这里说的收到,是怎么收到的?email里还是mailbox里啊,我怎么从来没收到开户奖励相关的任何文件