刚逛地里发现的帖子,震惊到我了,希望大家引以为戒。

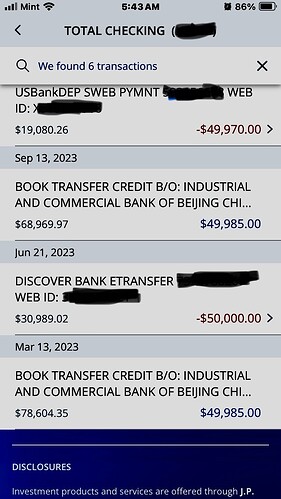

大致情况为楼主两年家里打了一共60w没有file Form 3520,结果几年后被irs罚了16w ![]()

3520真的是老生常谈的话题…感觉是IRS创收的一个大渠道

每年爸妈各打5w,然后总电汇收入10w以下就不用file任何东西?

不超过10w就不需要

自己给自己打5万呢

你自己给自己打还得考虑申报海外财产

但其实在中国也是我爸妈人民币转我的,一共少于15万,这种情况是3520吗?

你看3520填写说明,我印象是这样的。

相关的人累计,比如你爸8万你妈7万,加一起15万,那就得填表。如果村里王麻子给你9万,省里干爹给9万5,那其实是不需要的。3520只需要填表不用多交税,实在没必要该填却不填。

不过,除了本主题里的案例,之前被3520罚款的,至少中文案例里,绝大多数都是主动补交往年3520求心(自)安(守),然后irs笑纳罚款的。

如果一年里我妈汇款给我老婆5万,我岳父汇给我儿子5万,我舅舅汇给我5万,这种情况需要交3520吗?

你夫妻俩file jointly吗?儿子file tax return吗?

不超过十万就没事

更加麻烦,触发FBAR

3520填写说明里

Line 54. To calculate the threshold amount ($100,000), you must aggregate gifts from different foreign nonresident aliens and foreign estates if you know (or have reason to know) that those persons are related to each other (see Related Person , earlier) or one is acting as a nominee or intermediary for the other. For example, if you receive a gift of $75,000 from Abby (a nonresident alien individual) and a gift of $40,000 from Brian (a nonresident alien individual), and you know that Abby and Brian are related, you must answer “Yes” and complete columns (a) through (c) for each gift.

A related person generally includes any person who is related to you for purposes of sections 267 and 707(b). This includes, but is not limited to:

A member of your family—your brothers and sisters, half-brothers and half-sisters, spouse, ancestors (parents, grandparents, etc.), lineal descendants (children, grandchildren, etc.), and the spouses of any of these persons; or

A corporation in which you, directly or indirectly, own more than 50% in value of the outstanding stock.

If you and your spouse are filing a joint income tax return for the current tax year, and you are both transferors, grantors, or beneficiaries of the same foreign trust, then you may file a joint Form 3520 for the same tax year. If you and your spouse are filing a joint Form 3520, check the box on line 1i on page 1.

感觉报了踏实,省的将来跟IRS争辩你舅舅和你妈和岳父not related,除非能拿出大于5万的当年医疗费/学费账单。

我理解,十万整不算超10万,而且你不是9万9千多嘛(troll,扣的中间费用算谁的??)

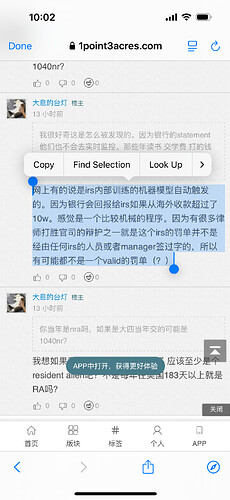

想问一下这个机制是什么 因为我在美国这些年全是自己给自己打的 没触发任何

所以这个机制是 一般来说 银行在个人账户海外汇款年度超过100K的情况下 会主动汇报给IRS???

还是IRS那边发现税表有问题去管银行要statement时发现的?

先后的流程到底是什么

之前有坛友说过银行觉得有问题 汇报的是FIN什么 而不是IRS 但是这里又说银行会tip IRS???

我晕了

那个楼里的楼主说是16,17年的事情了,这玩意追溯期这么久?为啥IRS过了这么久了突然发现这个事情?

应该不是银行tip的IRS吧

我现在也没搞懂IRS怎么知道的

这个先后到底是什么

我只是说理论上,触发了FBAR。即使你是拿签证的RA也要遵守FBAR。实际案例未知。

我觉得完全没必要吧,用父母的账号wire就行了。clean and simple