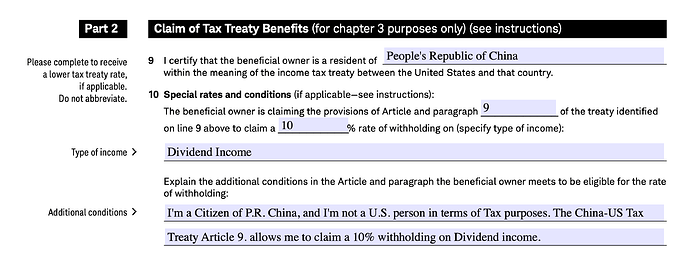

请教大家,为了能够只withhold 10% dividend income,是不是应该在W8-BEN的这个部分填写?在网上搜索了并没有找到相关模版,像我这么简单的写两句可以不~~

4天了还没人回你。。。

帮你 @plus1s 大神

太惨了我

帮你查了下这个问题,我认为你的填法是对的。

首先根据W-8BEN 的instruction part II

Line 10.

…

This line is generally not applicable to treaty benefits under an interest or dividends (other than dividends subject to a preferential rate based on ownership) article of a treaty.

这句话说利息和股息一般不适用,但例外是dividend在treaty里有preferrential rate。

US-China treaty article 9正是这种情况。

那么有没有通过填W-8BEN降低dividend withholding的呢?这篇文章专门讲了dividend

If you qualify for treaty benefits, you should fill out the treaty portion of Form W-8BEN (Part II) and specify the rate of withholding for dividends under the treaty. For individuals, the treaty rate for dividends is often 15%, but it depends on the treaty. Some treaties have a higher rate and some have a lower rate. You need to review your treaty to determine the appropriate rate.

我查了下UK, Japan, Canada, France的treaty,确实dividend rate是10%或者15%,所以大家应该都是用这个方法减小withholding的。

感谢哈总回复!

dividend和interest、royalties都是10%吗

嘉信电子 W8-BEN update 填写claimed 税率得地方只有四个选项0,7.5,15,30……根本没有10%…

只好选了个7.5 留了个note 说应该是10 无奈没选项。。。。