谢谢,我也是弹窗了

笑死, 不把茶色放眼里

我前天定的,昨天post,今天被杀。过两天可以给你dp

我感觉下面这个Reddit的帖子可能提示了一点真相?

Yesterday Amex closed my personal platinum, business plum, and even my authorized user card from my childhood. Just like everyone else they tell me to refer to the cardholder agreement, and that it was due to adherence to regulatory compliance (whatever that means).

Hearing many theories, but is this Amex preparing for a recession? Or are we truly not profitable as clients due to interchange fees with retailers being less than the 1.5% back we’re receiving.

https://www.reddit.com/r/amex/s/OpuF2YcheF

也就是说是违反了法律合规,而不是普通风控或者program abuse

下面是另外一个帖子,提到了suspicious spending activities

I’ve been an Amex cardholder for nearly 18 years and have had many of their cards over the years. Most recently, I had the Amex Gold.

Out of nowhere, I got an email saying my account was being canceled due to “indicia of misuse”. No warning, no prior issues on my end.

I called customer service and was passed around to multiple departments, none of which could give me a straight answer. Eventually, I was told to call different number — and the reps on that line were absolutely useless. They told me my account was closed due to “suspicious spending activity” but couldn’t (or wouldn’t) tell me what that actually meant.

https://www.reddit.com/r/amex/s/lI3pjZA5Qv

里面提到了suspicious activities 这又是一个AML的术语

最后大家经常提到的这次amex来信统一用 indicia of misuses,这个词语很怪,只在某些法律意境里会用,应该是律师写的。一查,果然如此,在FinCEN文书里常提到,比如下文

FinCEN will be able to monitor activity involving these entities “for indicia of the risks of” money laundering, terrorist financing, or other illicit finance activities and “consider regulatory measures if appropriate.” See AML Final Rule Release, 89 Fed. Reg. 72156, at 72178.

或者这篇文章

AML/CTF Red Flags And Indicia For Suspicious Activities

https://financialcrimeacademy.org/aml-ctf-red-flags-suspicious-activities/

Indicia就是一个AML和Sanction里的术语。

综上所述,判读这次还是基于AML由合规部门出马搞的项目,也就是BP之类,而不是猜测的其他什么NLL,撸羊毛之类。当然不排除Amex出于derisk角度假以AML理由杀一些其他的人,或者调查过程中发现其他违规顺便处理了。

另外AML的调查按法律必须是保密的,所以你问客服是不会说的。

再补充一点:AML/Sanction里最怕的是境外和跨境,所以这次有DP说是长居海外的用户和非美国公民被disproportionally impacted,也符合我对这次大规模杀全家是一次AML行动的判断。

就是现在all-in任何航司都是亏的,放弃mr的flexibility约等于自杀

当然我们也没干啥,没bg没bp没fluz没室友,只是上过public nll和报销而已

(敲木头)

没有bp

非常感谢你找到一个可能是老外的人被Amex关账户的DP分享,但这个楼主的陈述中没有提到他是否有接过BP,所以泥潭用户还是不能直接参考啊。

這你要自己跟 CPA 談,其實每個 CPA 看法都不太一樣

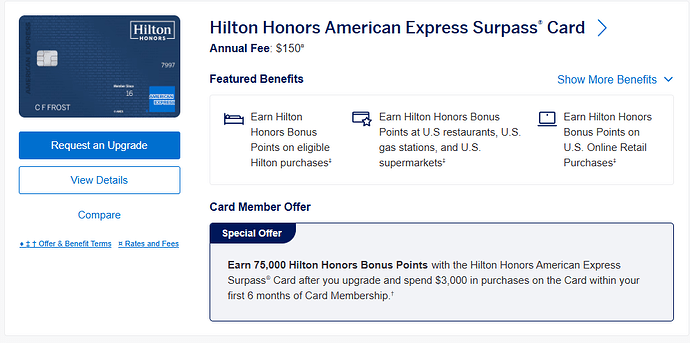

分享DP, 5.6 一次sp,5.14昨天一次sp,不过5.6这天我查了是rakuten的MR到账,然后昨天是金卡升降机白金的MR到账,外加昨天还看到HIlton无年费升级的offer(我想直接要Aspire的 ![]() )!

)!

所以这个sp会不会是其他功能啊?

我也发现,我原来是5.6被Amex 2 pull了一下,然后5.12又被pull了一下,也是这个情况

今早看是5/6 amex 2,刚才看是5/12 amex 2

從來沒這麽想被彈窗過

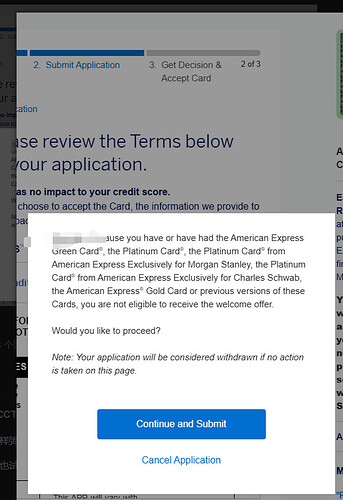

大家都可以用family rull来测试一下,如果能弹窗说明很可能问题不大

测试能否正常弹窗,

应该是目前最准确提前预知是否在案板上的方法

贴一个绿卡链接,大家可以测试一下,绿卡/白金/金是一组family rule。(别用信用卡,信用卡可能直接approve) AmEx Green “信用卡”【2024.10 更新:40k 开卡奖励;LoungeBuddy Credit 将被移除】 - 美国信用卡指南

按照上面总结,如果是已经上清单了,会直接pending cancel,去查,decline的原因是we cancelled one or more of your card before。这个秒拒的优先级应该跟returned payment秒拒、duplicate application,290处于同一等级

我个人觉得,“we cancelled a card before”应该是算法系统自动做的标记,然后真正杀是人工最后去confirm

没有弹。其实发生了2次。我P1 被杀完后,马上P2 申请了MS 白金,没有弹,直接pending,收到了带有ref的email,过了一天打电话去,还在pending,我让客服取消了。然后过了2天,我又申请了biz 白金refer 链接,这次也是直接进入pending,没有弹, 但没有收到email 确认。 我马上打电话去,客服说已经秒拒,因为we cancelled a card before. 但我P2并没有被他们取消卡,我猜 we cancelled a card before就是一个杀全家之前的标记。应该是amex 顺藤摸瓜,慢慢标记,慢慢杀。

非常赞同你的分析,这个帖子之下很多胡乱猜测真是太离谱了,真是一瓶子不满半瓶子晃荡。

分析是要基于事实、蛛丝马迹的,例如你给出的“Indicia”。而不是根据情绪的 ![]()

还是跟论坛博客上写的一样,这波就是Amex针对关于神医bp、itin开户的一次封杀。这次review面极广,有少数人可能是上了清单,被review杀了

Agree

长居海外的用户和非美国公民被disproportionally impacted,也符合我对这次大规模杀全家是一次AML行动的判断。

突然发现p2的checking目前显示restricted,根据p1的经验,下周二checking估计也要被杀了

有没有可能突然大量转分给一个常旅客账户然后被常旅客杀。 amex警告合作伙伴这些人有fraudulent activities

Amex能往我坛派卧底,我们为什么不能派个卧底去Amex![]() 呆三年就行

呆三年就行

你去是不是约等于在KFC招聘会上唱:更多选择更多欢笑尽在麦当劳!

所以要派个出身清白的

都不用杀,分太多了直接贬值就好了![]()

找几个白板会员:你们几个跟我时间最短,底子最清白

本来只是想看看有没有被杀风险,为啥在有白金和金卡的情况下给我approve了,虽然最后没接……没有family限制了?

将近4000台阶的大楼,终于看到一片有理有据的中肯分析。前面太多捕风捉影、牵强附会、garbage-in-garbage-out的相关性分析了。