WASHINGTON—The Trump administration is looking at options to provide Argentina a financial lifeline as the country struggles to overhaul its economy, U.S. Treasury Secretary Scott Bessent said Monday.

Bessent, in a series of posts on X, laid out the options administration officials are reviewing to backstop Argentina if the country under President Javier Milei’s leadership can’t overcome its financial woes.

“These options may include, but are not limited to, swap lines, direct currency purchases, and purchases of U.S. dollar-denominated government debt from Treasury’s Exchange Stabilization Fund,” Bessent said. He said the administration continues to think “fiscal discipline and pro-growth reforms are necessary to break Argentina’s long history of decline.”

Argentina’s assets rallied after the news. Argentina’s Merval Index rose 7.6% while the peso strengthened by more than 4%. The country risk, a measure of investor confidence, dropped sharply after climbing in recent days to its highest level in a year.

Milei, who first took office in late 2023, has won praise from President Trump and U.S. conservatives by slashing spending and criticizing the left. He has dismantled tariffs and import restrictions in a free-market shift. He brought monthly inflation down to 1.9% in July from nearly 26% when he took office in December 2023.

But Milei’s economic overhaul is facing growing opposition at home as the economy contracted in recent months. Unemployment has overtaken inflation as the top concern among Argentines, polls show, as jobs have failed to bounce back after the tough austerity. The unemployment rate was 7.6% in the second quarter, up from 5.7% when Milei took office in late 2023.

The use of the Treasury’s exchange stabilization fund could signal a major escalation in trying to assist Argentina. The fund, which was created in the 1930s, can be used to supply loans to foreign countries that are facing dire financial difficulties. Congress allows the Treasury secretary to have full control over the use of the exchange stabilization’s funds.

The White House and Treasury Department didn’t respond to requests for additional comment.

Brad Setser, a senior fellow at the Council on Foreign Relations, said that it would be “incredibly unusual” for the Trump administration to unilaterally provide financial assistance to Argentina, noting that the U.S. typically has taken such actions in coordination with other countries and the International Monetary Fund.

An exception occurred in 1995 when the U.S. offered $20 billion of loans to Mexico. But the proposed support for Argentina now could be “much riskier,” Setser said, because Argentina’s currency is less stable than Mexico’s was when it got its loan and because Argentina already owes large sums to the IMF.

Argentina has a long history of difficulties. It has been the International Monetary Fund’s biggest client, receiving 23 bailouts since the 1950s. Today, Argentina is the IMF’s largest debtor by far. In April, it signed its latest financing package worth $20 billion. That is on top of another bailout worth some $40 billion that Argentina received from the IMF stemming from a 2018 financial crisis.

Leah Traub, a portfolio manager who leads the currencies team at Lord Abbett, said that all of the options proposed by Bessent would entail giving Argentina dollars or otherwise supporting the peso, but that different options would carry different levels of risk.

Establishing a swap line with Argentina would effectively mean lending the country dollars that it could use to buy pesos, thereby strengthening the currency. In that case, Traub said, the U.S. would risk not getting repaid. But that would still be less risky than if the U.S. bought pesos, because the peso could potentially weaken much further against the dollar, sticking the U.S. government with an even bigger loss.

Purchasing new U.S. dollar-denominated Argentine government debt would just be another way for the U.S. to make a loan.

Bessent’s announcement comes a day before he and Trump are set to meet with Milei in New York City on the sidelines of the United Nations General Assembly. Milei thanked both Trump and Bessent.

“Those who defend the ideas of freedom should work together for the well-being of our people,” he wrote on X.

U.S. Treasury Chief Hints at Argentina Financial Rescue

Trump and Bessent prepare to meet with Argentine President Javier Milei as the country’s economy and currency slump

By

,

and

Updated Sept. 22, 2025 8:15 pm ET

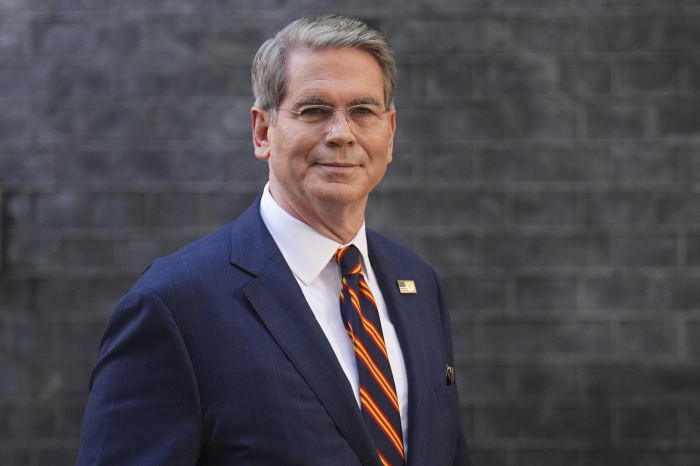

Treasury Secretary Scott Bessent Photo: James Manning/AP

-

Treasury Secretary Scott Bessent said the Trump administration is considering ways to provide Argentina with financial support.

-

Options for aiding Argentina include swap lines, direct currency purchases, and buying U.S. dollar-denominated government debt.

-

Argentina faces financial challenges and its leader is trying to pass free-market overhauls amid rising unemployment.

An artificial-intelligence tool created this summary, which was based on the text of the article and checked by an editor. Read more about how we use artificial intelligence in our journalism.

- Treasury Secretary Scott Bessent said the Trump administration is considering ways to provide Argentina with financial support.

View more

WASHINGTON—The Trump administration is looking at options to provide Argentina a financial lifeline as the country struggles to overhaul its economy, U.S. Treasury Secretary Scott Bessent said Monday.

Bessent, in a series of posts on X, laid out the options administration officials are reviewing to backstop Argentina if the country under President Javier Milei’s leadership can’t overcome its financial woes.

“These options may include, but are not limited to, swap lines, direct currency purchases, and purchases of U.S. dollar-denominated government debt from Treasury’s Exchange Stabilization Fund,” Bessent said. He said the administration continues to think “fiscal discipline and pro-growth reforms are necessary to break Argentina’s long history of decline.”

Argentina’s assets rallied after the news. Argentina’s Merval Index rose 7.6% while the peso strengthened by more than 4%. The country risk, a measure of investor confidence, dropped sharply after climbing in recent days to its highest level in a year.

Milei, who first took office in late 2023, has won praise from President Trump and U.S. conservatives by slashing spending and criticizing the left. He has dismantled tariffs and import restrictions in a free-market shift. He brought monthly inflation down to 1.9% in July from nearly 26% when he took office in December 2023.

But Milei’s economic overhaul is facing growing opposition at home as the economy contracted in recent months. Unemployment has overtaken inflation as the top concern among Argentines, polls show, as jobs have failed to bounce back after the tough austerity. The unemployment rate was 7.6% in the second quarter, up from 5.7% when Milei took office in late 2023.

The use of the Treasury’s exchange stabilization fund could signal a major escalation in trying to assist Argentina. The fund, which was created in the 1930s, can be used to supply loans to foreign countries that are facing dire financial difficulties. Congress allows the Treasury secretary to have full control over the use of the exchange stabilization’s funds.

The White House and Treasury Department didn’t respond to requests for additional comment.

Brad Setser, a senior fellow at the Council on Foreign Relations, said that it would be “incredibly unusual” for the Trump administration to unilaterally provide financial assistance to Argentina, noting that the U.S. typically has taken such actions in coordination with other countries and the International Monetary Fund.

An exception occurred in 1995 when the U.S. offered $20 billion of loans to Mexico. But the proposed support for Argentina now could be “much riskier,” Setser said, because Argentina’s currency is less stable than Mexico’s was when it got its loan and because Argentina already owes large sums to the IMF.

Argentina has a long history of difficulties. It has been the International Monetary Fund’s biggest client, receiving 23 bailouts since the 1950s. Today, Argentina is the IMF’s largest debtor by far. In April, it signed its latest financing package worth $20 billion. That is on top of another bailout worth some $40 billion that Argentina received from the IMF stemming from a 2018 financial crisis.

Leah Traub, a portfolio manager who leads the currencies team at Lord Abbett, said that all of the options proposed by Bessent would entail giving Argentina dollars or otherwise supporting the peso, but that different options would carry different levels of risk.

Establishing a swap line with Argentina would effectively mean lending the country dollars that it could use to buy pesos, thereby strengthening the currency. In that case, Traub said, the U.S. would risk not getting repaid. But that would still be less risky than if the U.S. bought pesos, because the peso could potentially weaken much further against the dollar, sticking the U.S. government with an even bigger loss.

Argentine President Javier Milei is dealing with a political backlash ahead of a midterm congressional vote next month. Photo: juan pablo pino/epa/shutterstock

Purchasing new U.S. dollar-denominated Argentine government debt would just be another way for the U.S. to make a loan.

Bessent’s announcement comes a day before he and Trump are set to meet with Milei in New York City on the sidelines of the United Nations General Assembly. Milei thanked both Trump and Bessent.

“Those who defend the ideas of freedom should work together for the well-being of our people,” he wrote on X.

Advertisement

Over the past two weeks, Argentina has faced deepening financial turbulence following an election in the province of Buenos Aires where Milei’s Freedom Advances party lost badly to his left-wing Peronist opponents.

The election rattled investors as it was seen as a harbinger for a crucial national midterm congressional vote in October. Milei is hoping to increase his support in that election to continue passing free-market overhauls that brought inflation down after painful austerity.

Last week, Argentina’s central bank dipped into its already depleted reserves to sell more than $1 billion of the U.S. currency over three days to defend the peso, which had weakened to the upper limit of its currency band.

On Friday, Milei told business leaders in the central city of Córdoba that “political panic” was driving the market turmoil. He recognized that the economic benefits haven’t reached everyone, but urged Argentines to give him more time.

“By no means am I saying that the problems are over,” Milei said in the speech. “But we have to keep going, keep pushing forward. Why? Because on the other side is the path to prosperity.”

Trevor Yates, an investment analyst at Global X, said a U.S. lifeline could bolster support for Milei ahead of the October congressional vote.

“Continued White House support for Milei’s fiscally orthodox agenda could further reduce market volatility and in turn bolster Milei’s support ahead of the all or nothing moment,” Yates said in emailed comments. “With the peso stabilizing and Milei moderating, we remain cautiously optimistic into October.”